Our YouTube video illustrates today's FOREX Trade of the Day and identifies further upside and downside price objectives.

Today's FOREX Trade of the Day was a short EUR/JPY position.

Entry Sell: 137.63

Exit Buy: 137.35

Notional Intraday Profit: +28 pips

Today's

intraday High of 137.71 was above 38.2% retracement of yesterday's Daily range, rendering

the retracement level a profitable Entry Sell level.

Today's intraday Low of 137.27 was below the 23.6% retracement

level of the range from the Low on 23 October through the High on 29 October, rendering the retracement level a profitable Exit Buy level.

Looking at the Monthly chart below, we can see how the October intramonth High was just below the 38.2% retracement of the cross rate's Lifetime range, from the Low in October 2000 through the High in July 2008.

Downside price objectives include 136.94, 135.86, 133.50, and. 132.03,

Trade Market Options

www.trademarketoptions.com

http://goo.gl/cEJnBZ

Thursday, October 30, 2014

Wednesday, October 29, 2014

SILVER: Bulls Have More than Sliver of Hope as Technicals Trade and Hold

Our YouTube video illustrates Silver's recent trading activity and identifies further upside price objectives.

As we can see on the Weekly chart below, technicians will want to see if Silver can register a Weekly Close above 17.10/ 17.24/ 17.37/ 17.54 if it cannot register a Close above 17.82.

The Monthly chart below is a key reminder about how much we have depreciated and upside price objectives, above which stops are likely positioned.

Upside price objectives include 17.82, 18.14, 19.89, and 20.85.

Trade Market Options

www.trademarketoptions.com

http://goo.gl/cEJnBZ

In our YouTube video and post from 16 October, we identified US$ 18.14 as an upside price objective from the retracement extension range related to the low of 15 October. In the Daily chart below, we can see several instances when Daily Lows have been right around retracement levels (blue up arrows) and Daily Highs have been right around retracement levels (orange down arrows).

As we can see on the Weekly chart below, technicians will want to see if Silver can register a Weekly Close above 17.10/ 17.24/ 17.37/ 17.54 if it cannot register a Close above 17.82.

The Monthly chart below is a key reminder about how much we have depreciated and upside price objectives, above which stops are likely positioned.

Upside price objectives include 17.82, 18.14, 19.89, and 20.85.

Trade Market Options

www.trademarketoptions.com

http://goo.gl/cEJnBZ

FOREX Trade of the Day: Buy AUD/CHF

Our YouTube video illustrates today's FOREX Trade of the Day and identifies further upside price objectives.

Today's FOREX Trade of the Day was a long AUD/CHF position.

Entry Buy: 0.8379

Exit Sell: 0.8405

Notional Intraday Profit: +26 pips

Today's intraday Low of 0.8379 was right around the 38.2% retracement of yesterday's Daily range, rendering the retracement level a profitable Entry Buy level.

Today's intraday High of 1.6060 was above the 76.4% retracement level of the October intramonth range, rendering the retracement level a profitable Exit Sell level.

Looking at the Monthly chart below, we can see how the October intramonth Low was just below the 50% retracement of the 2014 intrayear range.

Upside price objectives include 0.8498, 0.8745, 0.8879, and 0.9035.

Trade Market Options

www.trademarketoptions.com

http://goo.gl/cEJnBZ

Today's FOREX Trade of the Day was a long AUD/CHF position.

Entry Buy: 0.8379

Exit Sell: 0.8405

Notional Intraday Profit: +26 pips

Today's intraday Low of 0.8379 was right around the 38.2% retracement of yesterday's Daily range, rendering the retracement level a profitable Entry Buy level.

Today's intraday High of 1.6060 was above the 76.4% retracement level of the October intramonth range, rendering the retracement level a profitable Exit Sell level.

Looking at the Monthly chart below, we can see how the October intramonth Low was just below the 50% retracement of the 2014 intrayear range.

Upside price objectives include 0.8498, 0.8745, 0.8879, and 0.9035.

Trade Market Options

www.trademarketoptions.com

http://goo.gl/cEJnBZ

Tuesday, October 28, 2014

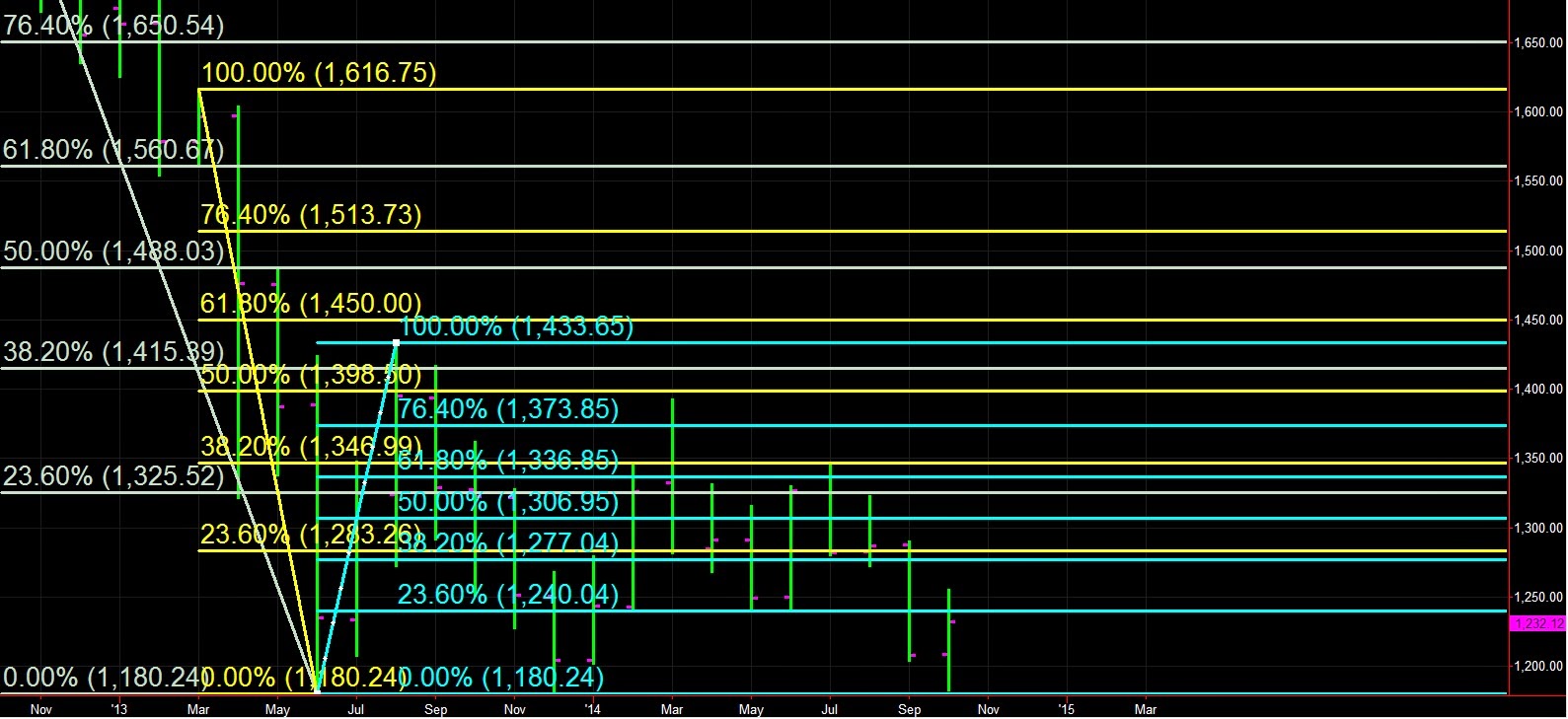

GOLD: Orbiting 1231.92 and Consolidating October's Gains

Our YouTube video illustrates Gold's recent moves against the US dollar and Gold's inability to sustain a move above the 1231.92 level.

As we can see in the Weekly chart below, Gold has had recent Weekly Closes above the 1221.17 and 1231.92 levels but was unable to close above the 1231.92 level last week.

As we can see in the Daily chart below, recent Highs and Lows have been around key levels related to the extension retracement range following the price activity of 15 October. We continue to view 1284 as an upside price objective related to this notional retracement extension range.

A close above 1240.04 on the Monthly chart below would be constructive and increase the possibility of a triple bottom formation.

Upside price objectives include 1244.85, 1262.52, and 1287.25.

Trade Market Options

www.trademarketoptions.com

http://goo.gl/cEJnBZ

As we can see in the Weekly chart below, Gold has had recent Weekly Closes above the 1221.17 and 1231.92 levels but was unable to close above the 1231.92 level last week.

As we can see in the Daily chart below, recent Highs and Lows have been around key levels related to the extension retracement range following the price activity of 15 October. We continue to view 1284 as an upside price objective related to this notional retracement extension range.

A close above 1240.04 on the Monthly chart below would be constructive and increase the possibility of a triple bottom formation.

Upside price objectives include 1244.85, 1262.52, and 1287.25.

Trade Market Options

www.trademarketoptions.com

http://goo.gl/cEJnBZ

FOREX Trade of the Day: Sell EUR/NZD

Our YouTube video illustrates today's FOREX Trade of the Day and identifies further downside price objectives.

Today's FOREX Trade of the Day was a short EUR/NZD position.

Entry Sell: 1.6098

Exit Buy: 1.6061

Notional Intraday Profit: +37 pips

Today's intraday High of 1.6106 was above the the 38.2% retracement of the range from the 22 October Low through the 24 October High, rendering the retracement level a profitable Entry Sell level.

Today's intraday Low of 1.6060 was just below the 50.0% retracement level of the same range, rendering the retracement level a profitable Exit Buy level.

Looking at the Weekly EUR/NZD chart below, we can see how the cross is just above a key retracement level of 1.6050 and how the market tested 1.5927 last week.

Downside price objectives include 1.5927, 1.5848, and 1.5654.

Trade Market Options

www.trademarketoptions.com

http://goo.gl/cEJnBZ

Today's FOREX Trade of the Day was a short EUR/NZD position.

Entry Sell: 1.6098

Exit Buy: 1.6061

Notional Intraday Profit: +37 pips

Today's intraday High of 1.6106 was above the the 38.2% retracement of the range from the 22 October Low through the 24 October High, rendering the retracement level a profitable Entry Sell level.

Today's intraday Low of 1.6060 was just below the 50.0% retracement level of the same range, rendering the retracement level a profitable Exit Buy level.

Looking at the Weekly EUR/NZD chart below, we can see how the cross is just above a key retracement level of 1.6050 and how the market tested 1.5927 last week.

Downside price objectives include 1.5927, 1.5848, and 1.5654.

Trade Market Options

www.trademarketoptions.com

http://goo.gl/cEJnBZ

Monday, October 27, 2014

APPLE: 1 week into ApplePay, AAPL Has $108 Handle in Sight

Our YouTube video illustrates Apple's move to an all-time High and identify some key upside price objectives.

Looking at the Daily chart below, the markets are looking to see if AAPL can establish a base above the previous High of 103.74. We can also see the $108 handle as an upside price objective related to an extension retracement.

The 95.90 level has been supportive in September and October as we can see on this Weekly chart below.

January 2014's move lower to 70.51 became a key extension retracement anchor and opened up the 119.54 level as a very aggressive upside price objective. We can see the October intramonth Low of 95.18 is just above the 38.2% retracement of that notional extension range in the Monthly chart below.

Trade Market Options

www.trademarketoptions.com

http://goo.gl/cEJnBZ

Looking at the Daily chart below, the markets are looking to see if AAPL can establish a base above the previous High of 103.74. We can also see the $108 handle as an upside price objective related to an extension retracement.

The 95.90 level has been supportive in September and October as we can see on this Weekly chart below.

January 2014's move lower to 70.51 became a key extension retracement anchor and opened up the 119.54 level as a very aggressive upside price objective. We can see the October intramonth Low of 95.18 is just above the 38.2% retracement of that notional extension range in the Monthly chart below.

Trade Market Options

www.trademarketoptions.com

http://goo.gl/cEJnBZ

FOREX: Australian Dollar the Top Trendsetter with Upside Burst

Our YouTube video illustrates the Australian Dollar's recent string of 6 consecutive Daily gains on our proprietary Australian Dollar Activity Index. This represented Aussie's best run since late August.

A$'s gains didn't really come at the expense of the US dollar as we can see in the AUD/USD chart below. The 0.8821 level has been good resistance.

We've seen some good selling pressure at 1.4509 in EUR/AUD as the Daily chart below shows.

The AUD/CAD Daily chart below shows some good demand around 0.9821 and 0.9789.

AUD/JPY has been a one-way street as we can see in the Daily chart below.

AUD/NZD has found good buying action at 1.1061 and 1.1006 as we can see on the Daily chart below.

GBP/AUD has had major problems at 1.8395 as we can see in the Daily chart below.

Finally, AUD/CHF demand has been decent at 0.8349 and 0.8230.

Trade Market Options

www.trademarketoptions.com

http://goo.gl/cEJnBZ

A$'s gains didn't really come at the expense of the US dollar as we can see in the AUD/USD chart below. The 0.8821 level has been good resistance.

We've seen some good selling pressure at 1.4509 in EUR/AUD as the Daily chart below shows.

The AUD/CAD Daily chart below shows some good demand around 0.9821 and 0.9789.

AUD/JPY has been a one-way street as we can see in the Daily chart below.

AUD/NZD has found good buying action at 1.1061 and 1.1006 as we can see on the Daily chart below.

GBP/AUD has had major problems at 1.8395 as we can see in the Daily chart below.

Finally, AUD/CHF demand has been decent at 0.8349 and 0.8230.

Trade Market Options

www.trademarketoptions.com

http://goo.gl/cEJnBZ

FOREX Trade of the Day: Buy EUR/USD

Our YouTube video illustrates today's FOREX Trade of the Day and identifies further upside price objectives.

Today's FOREX Trade of the Day was a long EUR/USD position.

Entry Buy: 1.2671

Exit Sell: 1.2699

Notional Intraday Profit: +28 pips

Today's intraday Low of 1.2671 was right around the the 38.2% retracement of Friday's Daily range, rendering the retracement level a profitable Entry Buy level.

Today's intraday High of 1.2713 was below the 38.2% retracement level of the range from the 21 October High through the 23 October Low, rendering the retracement level a profitable Exit Sell level.

Looking at the EUR/USD Monthly chart below, we can see how technical this trade has been with the intramonth High above a key retracement area dating to July 2008 and the October intramonth Low right around the 23.6% retracement of the range from July 2012 Low through the 2014 High.

Upside price objectives include 1.2782, 1.2853, 1.3054, 1.3247.

Trade Market Options

www.trademarketoptions.com

http://goo.gl/cEJnBZ

Today's FOREX Trade of the Day was a long EUR/USD position.

Entry Buy: 1.2671

Exit Sell: 1.2699

Notional Intraday Profit: +28 pips

Today's intraday Low of 1.2671 was right around the the 38.2% retracement of Friday's Daily range, rendering the retracement level a profitable Entry Buy level.

Today's intraday High of 1.2713 was below the 38.2% retracement level of the range from the 21 October High through the 23 October Low, rendering the retracement level a profitable Exit Sell level.

Looking at the EUR/USD Monthly chart below, we can see how technical this trade has been with the intramonth High above a key retracement area dating to July 2008 and the October intramonth Low right around the 23.6% retracement of the range from July 2012 Low through the 2014 High.

Upside price objectives include 1.2782, 1.2853, 1.3054, 1.3247.

Trade Market Options

www.trademarketoptions.com

http://goo.gl/cEJnBZ

Wednesday, October 22, 2014

GOLD Challenges 50-Day Moving Average On Ascent to 1284

Our YouTube video illustrates Gold's continued price appreciation and identifies key upside price objectives. In recent YouTube videos and posts, we have detailed Gold's technical momentum higher.

Looking at the Daily chart below, we can see our 1284 upside price objective, relating to an extension retracement area based on the 15 October Daily Low. We can see how recent Lows have been around key extension retracement areas, indicating upside price momentum. We also see how Gold is currently challenging the 50-day Moving Average.

Looking at the Weekly chart below, we can see that this week's Low and last week's Low have been above key technical retracement areas, related to the range from early July through early October and the absolute 2014 intrayear range. We also see Gold trading above the 1244.85 level, the 38.2% retracement of the range from July through October.

Downside price objectives include 1253.07, 1260.30, and 1284.20.

Trade Market Options

www.trademarketoptions.com

http://goo.gl/cEJnBZ

Looking at the Daily chart below, we can see our 1284 upside price objective, relating to an extension retracement area based on the 15 October Daily Low. We can see how recent Lows have been around key extension retracement areas, indicating upside price momentum. We also see how Gold is currently challenging the 50-day Moving Average.

Downside price objectives include 1253.07, 1260.30, and 1284.20.

Trade Market Options

www.trademarketoptions.com

http://goo.gl/cEJnBZ

FOREX Trade of the Day: Sell GBP/NZD

Our YouTube video illustrates today's FOREX Trade of the Day and identifies further downside price objectives.

Today's FOREX Trade of the Day was a short GBP/NZD position.

Entry Sell: 2.0262

Exit Buy: 2.0189

Notional Intraday Profit: +73 pips

Today's intraday High of of 2.0265 was just above the the 38.2% retracement of the range from yesterday's High through yesterday's Close, rendering the retracement level a profitable Entry Sell level.

Today's intraday Low of 2.0169 was below the 50.0% retracement level of the range from the 15 October Low through the 16 October High, rendering the retracement level a profitable Exit Buy level.

Looking at this cross rate's Monthly chart below, we can see how technically this cross has traded in 2013 and 2014, as identified by up and down arrows. GBP/NZD may be a cross rate that most FX traders don't follow, but this is another validation that there is often more alpha on the cross rates than the majors.

Downside price objectives include 2.0115, 2.0068, and 1.9836.

Trade Market Options

www.trademarketoptions.com

http://goo.gl/cEJnBZ

Today's FOREX Trade of the Day was a short GBP/NZD position.

Entry Sell: 2.0262

Exit Buy: 2.0189

Notional Intraday Profit: +73 pips

Today's intraday High of of 2.0265 was just above the the 38.2% retracement of the range from yesterday's High through yesterday's Close, rendering the retracement level a profitable Entry Sell level.

Today's intraday Low of 2.0169 was below the 50.0% retracement level of the range from the 15 October Low through the 16 October High, rendering the retracement level a profitable Exit Buy level.

Looking at this cross rate's Monthly chart below, we can see how technically this cross has traded in 2013 and 2014, as identified by up and down arrows. GBP/NZD may be a cross rate that most FX traders don't follow, but this is another validation that there is often more alpha on the cross rates than the majors.

Downside price objectives include 2.0115, 2.0068, and 1.9836.

Trade Market Options

www.trademarketoptions.com

http://goo.gl/cEJnBZ

Tuesday, October 21, 2014

FOREX Trade of the Day: Sell USD/JPY

Our YouTube video illustrates today's FOREX Trade of the Day and identifies further downside price objectives.

Today's FOREX Trade of the Day was a short USD/JPY position.

Entry Sell: 107.00

Exit Buy: 106.28

Notional Intraday Profit: +72 pips

Today's intraday High of of 107.00 was right around the 38.82% retracement of yesterday's Daily range, rendering the retracement level a profitable Entry Sell level.

Today's intraday Low of 106.24 was below the 50.0% retracement level of the range from the 15 October Low through yesterday's High, rendering the retracement level a profitable Exit Buy level.

Look at the Monthly chart below and see how the October intramonth Low was just below the 50% retracement of the range from the High in early 2002 through the Low in late 2011.

Downside price objectives include 105.60, 103.85, and 103.10.

Trade Market Options

www.trademarketoptions.com

http://goo.gl/cEJnBZ

Today's FOREX Trade of the Day was a short USD/JPY position.

Entry Sell: 107.00

Exit Buy: 106.28

Notional Intraday Profit: +72 pips

Today's intraday High of of 107.00 was right around the 38.82% retracement of yesterday's Daily range, rendering the retracement level a profitable Entry Sell level.

Today's intraday Low of 106.24 was below the 50.0% retracement level of the range from the 15 October Low through yesterday's High, rendering the retracement level a profitable Exit Buy level.

Look at the Monthly chart below and see how the October intramonth Low was just below the 50% retracement of the range from the High in early 2002 through the Low in late 2011.

Downside price objectives include 105.60, 103.85, and 103.10.

Trade Market Options

www.trademarketoptions.com

http://goo.gl/cEJnBZ

Monday, October 20, 2014

OIL: After Technical Thursday, Oil Bears Refocus on Our Downside Targets

Our YouTube video

illustrates the recent price activity in Brent crude Oil and WTI Oil and examines the technical significance of Thursday's short-lived pullbacks higher.

In the Brent crude Oil Daily chart below, we see that Thursday's retracement higher was to the 23.6% retracement of the High from 26 August through the October intramonth Low.

Similarly, in the WTI Oil Daily chart below, we see that Thursday's retracement higher was to the 23.6% retracement of our downside price objective.

Trading activity since the Thursday moves higher has been technical, including today's trading activty.

First in Brent crude...

Second in WTI...

Our downside price objective for Brent crude remain unchanged as we can see on the following Monthly chart. We still anticipate a move lower to the $81 handle.

Likewise, our downside price objective for WTI Oil remains unchanged with a pullback to the $76-77 handle area possible.

Trade Market Options

www.trademarketoptions.com

http://goo.gl/cEJnBZ

In the Brent crude Oil Daily chart below, we see that Thursday's retracement higher was to the 23.6% retracement of the High from 26 August through the October intramonth Low.

Similarly, in the WTI Oil Daily chart below, we see that Thursday's retracement higher was to the 23.6% retracement of our downside price objective.

Trading activity since the Thursday moves higher has been technical, including today's trading activty.

First in Brent crude...

Second in WTI...

Our downside price objective for Brent crude remain unchanged as we can see on the following Monthly chart. We still anticipate a move lower to the $81 handle.

Likewise, our downside price objective for WTI Oil remains unchanged with a pullback to the $76-77 handle area possible.

Trade Market Options

www.trademarketoptions.com

http://goo.gl/cEJnBZ

DOW (DJIA): Fed Talked Dow Higher Last Week to 16,426

Our YouTube video illustrates Friday's trading activity in the Dow Jones Industrial Average (DJIA) following verbal intervention from the Federal Reserve including market-supportive comments last week from St. Louis Federal Reserve President Bullard.

As we can see in the Daily chart below, the Dow's Daily High was right around the 38.2% retracement of the range from the all-time High reached in September through the October intramonth Low.

We also see the 15615 level, the area that would represent a technical correction.

Looking at the Monthly chart below, we can see that the market hasn't yet tested the 15711 level in October but that it is an important technical level.

The markets should not be surprised that we perfectly tested the 16426 area on Friday. Looking at the Weekly chart below, we see how the 16096 level is significant technically.

That's why the market elected more than $150 in Stops below this level in the first 10 minutes of trading last Wednesday as we can see in this 5-minute chart below.

Downside price objectives remain 15711, 15524, and 15320.

Trade Market Options

www.trademarketoptions.com

http://goo.gl/cEJnBZ

As we can see in the Daily chart below, the Dow's Daily High was right around the 38.2% retracement of the range from the all-time High reached in September through the October intramonth Low.

We also see the 15615 level, the area that would represent a technical correction.

Looking at the Monthly chart below, we can see that the market hasn't yet tested the 15711 level in October but that it is an important technical level.

The markets should not be surprised that we perfectly tested the 16426 area on Friday. Looking at the Weekly chart below, we see how the 16096 level is significant technically.

That's why the market elected more than $150 in Stops below this level in the first 10 minutes of trading last Wednesday as we can see in this 5-minute chart below.

Downside price objectives remain 15711, 15524, and 15320.

Trade Market Options

www.trademarketoptions.com

http://goo.gl/cEJnBZ

GOLD: 2 Previous Weekly Closes Keep Spotlight on 1284

Our YouTube video illustrates Gold's previous two Weekly Closes above key retracement areas and we examine how Gold remains constructive as a result. A Gold video and post that we uploaded last week discusses the significance of recent ranges and we uploaded a similar Silver YouTube video and Silver post today.

Looking at the Weekly chart below, we can see the two previous Weekly Closes above 1221.17 and 1231.92 were technically significant, as was Gold's Low last week above the 1221.17 level.

Looking at the Daily chart below, we see the retracement extension range related to the October intramonth Low and wide range from 15 October and see how today's intraday Low and High are right between key retracement levels.

Upside price objectives remain 1245.51, 1253.07, 1269.65, and 1284.20.

Trade Market Options

www.trademarketoptions.com

http://goo.gl/cEJnBZ

Looking at the Weekly chart below, we can see the two previous Weekly Closes above 1221.17 and 1231.92 were technically significant, as was Gold's Low last week above the 1221.17 level.

Looking at the Daily chart below, we see the retracement extension range related to the October intramonth Low and wide range from 15 October and see how today's intraday Low and High are right between key retracement levels.

Upside price objectives remain 1245.51, 1253.07, 1269.65, and 1284.20.

Trade Market Options

www.trademarketoptions.com

http://goo.gl/cEJnBZ

SILVER: Trading Perfectly In Line Today with Our Target from Last Week

Our YouTube video illustrates Silver's intraday trading activity today and shows how the Daily High and Daily Low have been around key retracement levels from the 18.14 target identified in our YouTube video and corresponding post last week.

As we can see in the screenshot from our Daily chart below, the intraday Low is right around the 61.8% retracement of the retracement extension range and the intraday High is around the 50.0% retracement of the same retracement extension range.

In the Monthly chart below, the significance of the 17.82, 17.97, and 18.66 levels remains very clear. Silver needs to register a Close above these areas if it is to form a constructive base for a move higher.

Upside price objectives remain 17.97, 18.14, 18.66, and 19.89.

Trade Market Options

www.trademarketoptions.com

http://goo.gl/cEJnBZ

As we can see in the screenshot from our Daily chart below, the intraday Low is right around the 61.8% retracement of the retracement extension range and the intraday High is around the 50.0% retracement of the same retracement extension range.

In the Monthly chart below, the significance of the 17.82, 17.97, and 18.66 levels remains very clear. Silver needs to register a Close above these areas if it is to form a constructive base for a move higher.

Upside price objectives remain 17.97, 18.14, 18.66, and 19.89.

Trade Market Options

www.trademarketoptions.com

http://goo.gl/cEJnBZ

FOREX Trade of the Day: Buy CHF/JPY

Our YouTube video illustrates today's FOREX Trade of the Day and identifies further upside and downside price objectives.

Today's FOREX Trade of the Day was a long CHF/JPY position.

Entry Buy: 112.98

Exit Sell: 113.39

Notional Intraday Profit: +41 pips

Today's intraday Low of of 112.98 was right around the 61.8% retracement of the range from 2 October through 16 October, rendering the retracement level a profitable Entry Buy level.

Today's intraday High of 113.42 was right around the 76.4% retracement level of the October intramonth range, rendering the retracement level a profitable Exit Sell level.

Look how the the October intramonth Low is right around the 23.6% retracement of the range from the April 2013 Low through the December 2013 High.

Upside price objectives include 113.82 and 114.55.

Downside price objectives include 112.64 and 111.87.

Trade Market Options

www.trademarketoptions.com

http://goo.gl/cEJnBZ

Today's FOREX Trade of the Day was a long CHF/JPY position.

Entry Buy: 112.98

Exit Sell: 113.39

Notional Intraday Profit: +41 pips

Today's intraday Low of of 112.98 was right around the 61.8% retracement of the range from 2 October through 16 October, rendering the retracement level a profitable Entry Buy level.

Today's intraday High of 113.42 was right around the 76.4% retracement level of the October intramonth range, rendering the retracement level a profitable Exit Sell level.

Look how the the October intramonth Low is right around the 23.6% retracement of the range from the April 2013 Low through the December 2013 High.

Upside price objectives include 113.82 and 114.55.

Downside price objectives include 112.64 and 111.87.

Trade Market Options

www.trademarketoptions.com

http://goo.gl/cEJnBZ

Friday, October 17, 2014

5 Things Traders are Watching Next Week, or "More Pain for Eurozone Peripherals"

5 Things Traders are Watching Next Week

1. The Japanese yen has been on a tear. Our proprietary JPY Activity Index has been

applied to a Weekly chart in the

screenshot below. Notice how the yen’s recent activity has represented its most

sustained period of gains since January 2014. Also notice how these gains have

come on the heels of the most intense selling pressure during August and September

since Q1 2014 and Q4 2013. Some traders may have noticed how “Mr Yen”

Sakakibara talked the yen higher recently, questioning whether the former MoF

mandarin still has some sway. After

being rangebound between April and July, the yen has awakened.

Japanese data released this week

were not pretty. The Domestic Corporate Goods Price Index moderated to +3.5%

y/y in September and was off 0.1% m/m and many traders are questioning the

efficacy of Abenomics. Isn’t it about time for a supplementary Japanese

government budget too? Industrial production worsened sharply in August and

Tokyo condominium sales remained rough. Recent capital flows data have shown a

big rotation by Japanese investors into foreign fixed income from foreign

equities while foreigners dumped Japanese equities and nearly halved their

purchases of Japanese equities.

Various Japanese data are due

next week but the markets are likely to focus on September’s trade balance the

most.

2. Oil remain in a state of freefall. During periods of heightened geopolitical risk (think Iraq, Ukraine, and [insert your favourite global hotspot here]), the markets expect bigger and better prints out of the energy markets. Alas, they have no such luck at present. There are quite a few factors at play here that bear attention. OPEC is said to be as divisive as ever. Recent comments out of Saudi Arabia have done little to support prices. The US’s shale energy revolution is alive and well, with many estimates suggesting the US is capable of becoming the world’s largest oil producer. The US dollar appreciated sharply between July and early October, making it more expensive for countries to sell their own currencies for dollars to buy oil.

Additionally, Congressional

midterms are coming up in the US, and wouldn’t it be great for Democrats to

point to lower gasoline and home heating prices as voters head to the polls? Moreover, there are geopolitics at play in the

markets. Energy exporters like Russia

and Venezuela are feeling some economic pain as a result of the depreciation in

prices, perhaps a welcome byproduct for foreign policy directed at ongoing

Russian tensions with Ukraine.

Take a peek at our Brent crude Daily chart below. We identified the

$84 handle as a downside target weeks ago and eye the $81 handle as another possibility.

Ditto with the WTI Daily chart below. We identified the

$82 handle as a downside target weeks ago, and the $76-77 area is another area

of possible technical exhaustion.

3. The big C word: Correction. Global equity markets are in a state of

mishmash. Let’s focus on the US for now. After the Dow’s recent High of 17,350, the Dow would have to get down to

15,615 to be in an official correction mode.

NASDAQ peaked around the same

time at 4,610, rendering 4,149 the level for a technical correction – below

which we traded this week. Likewise, after a brief dalliance above the

psychologically-important 2,000 level, the 1817 area remains a formal

correction level for the S&P –

and we’re not too far from there now.

We could reproduce a boring

popular mainstream equities index here, but you can find that on lesser blogs. There

are many sectors we could spotlight, but with the Ebola hysteria near

full-swing, investors have been dumping airlines shares en masse. It’s no

surprise that the Weekly Dow Jones Airlines Index looks like the screenshot

below. Will the global equities pullback continue?

4. From big C to…another big C: China. Remember the good ol’ days when China would store up their

economic data and release it on weekends whenever they pleased? Those episodes

are happening with less frequency nowadays, which means the statistical juggernaut

in Beijing is hard at work to deliver some premium numbers next week.

This week, we learned the

September Chinese trade balance came in below consensus at US$ 31.0 billion

with exports up 15.3% y/y and imports up 7% y/y. Likewise, September CPI growth

decelerated to +1.6% y/y and PPI moved from -1.2% y/y in August to -1.8% y/y in

September. If the world’s manufacturing growth engine is experiencing deflation

in its factory gate chain, how does that bode for global disinflation?

Next week, Beijing will share

September retail sales data on Tuesday with a pullback to +11.7% y/y expected.

September industrial production are also due and could climb to +7.5% y/y and

Q3 GDP data are expected at +1.8% q/q and +7.2% y/y. October HSBC manufacturing PMI data are

expected on Thursday and last month’s print at 50.2 could give way to slip

below the boom-or-bust 50.0 level, denoting contraction.

Looking at the Monthly USD/CNY chart below, we can’t help but

think that some big Chinese money knows their technicals extremely well.

Traders are especially attuned to

China now given the country’s vast accumulation of bad loans with the property

and corporate sectors looking very feeble. Bank of China is planning to issue

US$ 6.5 billion in new shares to international investors to bolster its capital

base, likely a necessity given the amount of leverage that Chinese banks have

piled on. The markets are also paying

close attention to Chinese foreign reserves as their decline in the third

quarter was the largest on record.

5. The Eurozone

periphery is back at it. Credit

spreads in Greece, Portugal, Italy, and Spain widened this week as investors

speculated the Eurozone’s increasingly fragile economic recovery may have run

its course. Greek 10-year government debt is now yielding around 9%, a level that may test its commitment to the troika or and jeopardise its return to the credit markets. This

latest round of peripheral credit woes will again challenge Germany’s steely

commitment to austerity, whereas France, Italy, and other member states will

seek room to expand fiscal spending.

European Union leaders will convene a summit next week in which they

will face the grim reality that the European Central Bank’s latest monetary

policy accommodation may not suffice to turn around an otherwise impotent

economy. Ironically, it was just weeks ago that investors were piling in to Eurozone

peripheral assets, pushing prices to levels deemed unsustainable. A worsening in

asset prices and increases in credit default swap rates will have many traders

considering yesteryear’s crisis.

Subscribe to:

Posts (Atom)