Our YouTube video illustrates today's FOREX Trade of the Day and identifies downside price objectives.

Today's FOREX Trade of the Day was a short EUR/NZD position.

Entry Sell: 1.5986

Exit Buy: 1.5887

Notional Intraday Profit: +99 pips

Today's

intraday High of 1.5988 was above the 38.2% retracement of yesterday's Daily range, rendering

the retracement level a profitable Entry Sell level.

Today's intraday Low of 1.5875 was below the 76.4% retracement

level of the September Monthly range, rendering the retracement level a profitable Exit Buy level.

Looking at the Monthly chart below, we can see the market may test the 1.5848 level, representing the 61.8% retracement of the Low from August 2012 through the High of August 2013.

Downside price objectives include 1.5848, 1.5654, and 1.5510.

Trade Market Options

www.trademarketoptions.com

http://goo.gl/cEJnBZ

Wednesday, November 12, 2014

Tuesday, November 11, 2014

FOREX Trade of the Day: Buy USD/JPY

Our YouTube video illustrates today's FOREX Trade of the Day and identifies upside price objectives.

Today's FOREX Trade of the Day was a long USD/JPY position.

Entry Buy: 114.65

Exit Sell: 115.16

Notional Intraday Profit: +51 pips

Today's intraday Low of 114.62 was below the 23.6% retracement of Friday's Daily range, rendering the retracement level a profitable Entry Buy level.

Today's intraday High of 116.00 was above the 76.4% retracement level of the range from last Thursday's High through last Friday's Low, rendering the retracement level a profitable Exit Sell level.

Looking at the Monthly chart below, we can see the Weekly Open from last week gapped and opened above the 112.37 and 112.66 levels, representing key retracement levels related to the High from January 2002 and the High from June 2007, respectively.

Upside price objectives include 120.11 and 121.07.

Trade Market Options

www.trademarketoptions.com

http://goo.gl/cEJnBZ

Today's FOREX Trade of the Day was a long USD/JPY position.

Entry Buy: 114.65

Exit Sell: 115.16

Notional Intraday Profit: +51 pips

Today's intraday Low of 114.62 was below the 23.6% retracement of Friday's Daily range, rendering the retracement level a profitable Entry Buy level.

Today's intraday High of 116.00 was above the 76.4% retracement level of the range from last Thursday's High through last Friday's Low, rendering the retracement level a profitable Exit Sell level.

Looking at the Monthly chart below, we can see the Weekly Open from last week gapped and opened above the 112.37 and 112.66 levels, representing key retracement levels related to the High from January 2002 and the High from June 2007, respectively.

Upside price objectives include 120.11 and 121.07.

Trade Market Options

www.trademarketoptions.com

http://goo.gl/cEJnBZ

Wednesday, November 5, 2014

APPLE: Reached Our $108 Target and Eyes New Upside Price Objectives

Our YouTube video illustrates Apple's (AAPL) move through our $108 price objective this week. Our video from 27 October identified the $108 upside target and our video from 30 September discussed Apple's upside price potential. Our recent blog post from 27 October also identified this.

Looking at the Daily chart below, we can see the $108 upside price objective. After Apple reached our previous upside price objective of $103.74 on 22 October, we identified the $108 handle.

Looking at the Monthly chart below, we can see the $116 and $120 levels as additional upside price objectives.

Trade Market Options

www.trademarketoptions.com

http://goo.gl/cEJnBZ

Looking at the Daily chart below, we can see the $108 upside price objective. After Apple reached our previous upside price objective of $103.74 on 22 October, we identified the $108 handle.

Looking at the Weekly chart below, we see the $111 and $119 levels as new upside price objectives.

Looking at the Monthly chart below, we can see the $116 and $120 levels as additional upside price objectives.

Trade Market Options

www.trademarketoptions.com

http://goo.gl/cEJnBZ

FOREX Trade of the Day: Buy EUR/GBP

Our YouTube video illustrates today's FOREX Trade of the Day and identifies upside price objectives.

Today's FOREX Trade of the Day was a long EUR/GBP position.

Entry Buy: 0.7836

Exit Sell: 0.7856

Notional Intraday Profit: +20 pips

Today's intraday Low of 0.7836 was right around the 38.2% retracement of yesterday's Daily range, rendering the retracement level a profitable Entry Buy level.

Today's intraday High of 0.7858 was above the 23.6% retracement level of the range from the October High through the November intramonth Low, rendering the retracement level a profitable Exit Sell level.

Looking at the Monthly chart below, we can see recent tests of the 0.7783 level, relating to the 61.8% retracement of the January 2007 Low through the December 2008 High. We can also see cross holding above the 0.7740 level, representing the 50% retracement of the May 2000 Low through the December 2008 High - representing the Lifetime historical range of the Euro.

Downside price objectives include 0.7740, 0.7500, and 0.7315.

Trade Market Options

www.trademarketoptions.com

http://goo.gl/cEJnBZ

Today's FOREX Trade of the Day was a long EUR/GBP position.

Entry Buy: 0.7836

Exit Sell: 0.7856

Notional Intraday Profit: +20 pips

Today's intraday Low of 0.7836 was right around the 38.2% retracement of yesterday's Daily range, rendering the retracement level a profitable Entry Buy level.

Today's intraday High of 0.7858 was above the 23.6% retracement level of the range from the October High through the November intramonth Low, rendering the retracement level a profitable Exit Sell level.

Looking at the Monthly chart below, we can see recent tests of the 0.7783 level, relating to the 61.8% retracement of the January 2007 Low through the December 2008 High. We can also see cross holding above the 0.7740 level, representing the 50% retracement of the May 2000 Low through the December 2008 High - representing the Lifetime historical range of the Euro.

Downside price objectives include 0.7740, 0.7500, and 0.7315.

Trade Market Options

www.trademarketoptions.com

http://goo.gl/cEJnBZ

Tuesday, November 4, 2014

FOREX Trade of the Day: Sell AUD/USD

Our YouTube video illustrates today's FOREX Trade of the Day and identifies downside price objectives.

Today's FOREX Trade of the Day was a short AUD/USD position.

Entry Sell: 0.8708

Exit Buy: 0.8671

Notional Intraday Profit: +37 pips

Today's intraday High of 0.8708 (at the time) was right around the 38.2% retracement of yesterday's Daily range, rendering the retracement level a profitable Entry Sell level.

Today's intraday Low of 0.8644 was below the 38.2% retracement level of the range from April 2001 through July 2011, rendering the retracement level a profitable Exit Buy level.

Looking at the Monthly chart below, we can see why we chose today's Exit Buy level of 0.8671, observing that it is the 38.2% retracement of the 2001 - 2011 range.

Downside price objectives include 0.8543 and 0.7945.

Trade Market Options

www.trademarketoptions.com

http://goo.gl/cEJnBZ

Today's FOREX Trade of the Day was a short AUD/USD position.

Entry Sell: 0.8708

Exit Buy: 0.8671

Notional Intraday Profit: +37 pips

Today's intraday High of 0.8708 (at the time) was right around the 38.2% retracement of yesterday's Daily range, rendering the retracement level a profitable Entry Sell level.

Today's intraday Low of 0.8644 was below the 38.2% retracement level of the range from April 2001 through July 2011, rendering the retracement level a profitable Exit Buy level.

Looking at the Monthly chart below, we can see why we chose today's Exit Buy level of 0.8671, observing that it is the 38.2% retracement of the 2001 - 2011 range.

Downside price objectives include 0.8543 and 0.7945.

Trade Market Options

www.trademarketoptions.com

http://goo.gl/cEJnBZ

Monday, November 3, 2014

FOREX Trade of the Day: Buy USD/CHF

Our YouTube video illustrates today's FOREX Trade of the Day and identifies further upside price objectives.

Today's FOREX Trade of the Day was a long USD/CHF position.

Entry Buy: 0.9636

Exit Sell: 0.9682

Notional Intraday Profit: +46 pips

Today's intraday Low of 0.9635 was above 23.6% retracement of Friday's Daily range, rendering the retracement level a profitable Entry Buy level.

Today's intraday High of 0.9690 was above the 50% retracement level of the range from November 2008 through August 2011, rendering the retracement level a profitable Exit Sell level.

Looking at the Monthly chart below, we can see that today's intraday High was just below the 23.6% retracement of the range from October 2000 through August 2011. This range coincides with the pair's relative High and Low during the lifetime of the Euro.

Upside price objectives include 0.9720, 1.0175, and 1.0299.

Trade Market Options

www.trademarketoptions.com

http://goo.gl/cEJnBZ

Today's FOREX Trade of the Day was a long USD/CHF position.

Entry Buy: 0.9636

Exit Sell: 0.9682

Notional Intraday Profit: +46 pips

Today's intraday Low of 0.9635 was above 23.6% retracement of Friday's Daily range, rendering the retracement level a profitable Entry Buy level.

Today's intraday High of 0.9690 was above the 50% retracement level of the range from November 2008 through August 2011, rendering the retracement level a profitable Exit Sell level.

Looking at the Monthly chart below, we can see that today's intraday High was just below the 23.6% retracement of the range from October 2000 through August 2011. This range coincides with the pair's relative High and Low during the lifetime of the Euro.

Upside price objectives include 0.9720, 1.0175, and 1.0299.

Trade Market Options

www.trademarketoptions.com

http://goo.gl/cEJnBZ

Thursday, October 30, 2014

FOREX Trade of the Day: Sell EUR/JPY

Our YouTube video illustrates today's FOREX Trade of the Day and identifies further upside and downside price objectives.

Today's FOREX Trade of the Day was a short EUR/JPY position.

Entry Sell: 137.63

Exit Buy: 137.35

Notional Intraday Profit: +28 pips

Today's intraday High of 137.71 was above 38.2% retracement of yesterday's Daily range, rendering the retracement level a profitable Entry Sell level.

Today's intraday Low of 137.27 was below the 23.6% retracement level of the range from the Low on 23 October through the High on 29 October, rendering the retracement level a profitable Exit Buy level.

Looking at the Monthly chart below, we can see how the October intramonth High was just below the 38.2% retracement of the cross rate's Lifetime range, from the Low in October 2000 through the High in July 2008.

Downside price objectives include 136.94, 135.86, 133.50, and. 132.03,

Trade Market Options

www.trademarketoptions.com

http://goo.gl/cEJnBZ

Today's FOREX Trade of the Day was a short EUR/JPY position.

Entry Sell: 137.63

Exit Buy: 137.35

Notional Intraday Profit: +28 pips

Today's intraday High of 137.71 was above 38.2% retracement of yesterday's Daily range, rendering the retracement level a profitable Entry Sell level.

Today's intraday Low of 137.27 was below the 23.6% retracement level of the range from the Low on 23 October through the High on 29 October, rendering the retracement level a profitable Exit Buy level.

Looking at the Monthly chart below, we can see how the October intramonth High was just below the 38.2% retracement of the cross rate's Lifetime range, from the Low in October 2000 through the High in July 2008.

Downside price objectives include 136.94, 135.86, 133.50, and. 132.03,

Trade Market Options

www.trademarketoptions.com

http://goo.gl/cEJnBZ

Wednesday, October 29, 2014

SILVER: Bulls Have More than Sliver of Hope as Technicals Trade and Hold

Our YouTube video illustrates Silver's recent trading activity and identifies further upside price objectives.

As we can see on the Weekly chart below, technicians will want to see if Silver can register a Weekly Close above 17.10/ 17.24/ 17.37/ 17.54 if it cannot register a Close above 17.82.

The Monthly chart below is a key reminder about how much we have depreciated and upside price objectives, above which stops are likely positioned.

Upside price objectives include 17.82, 18.14, 19.89, and 20.85.

Trade Market Options

www.trademarketoptions.com

http://goo.gl/cEJnBZ

In our YouTube video and post from 16 October, we identified US$ 18.14 as an upside price objective from the retracement extension range related to the low of 15 October. In the Daily chart below, we can see several instances when Daily Lows have been right around retracement levels (blue up arrows) and Daily Highs have been right around retracement levels (orange down arrows).

As we can see on the Weekly chart below, technicians will want to see if Silver can register a Weekly Close above 17.10/ 17.24/ 17.37/ 17.54 if it cannot register a Close above 17.82.

The Monthly chart below is a key reminder about how much we have depreciated and upside price objectives, above which stops are likely positioned.

Upside price objectives include 17.82, 18.14, 19.89, and 20.85.

Trade Market Options

www.trademarketoptions.com

http://goo.gl/cEJnBZ

FOREX Trade of the Day: Buy AUD/CHF

Our YouTube video illustrates today's FOREX Trade of the Day and identifies further upside price objectives.

Today's FOREX Trade of the Day was a long AUD/CHF position.

Entry Buy: 0.8379

Exit Sell: 0.8405

Notional Intraday Profit: +26 pips

Today's intraday Low of 0.8379 was right around the 38.2% retracement of yesterday's Daily range, rendering the retracement level a profitable Entry Buy level.

Today's intraday High of 1.6060 was above the 76.4% retracement level of the October intramonth range, rendering the retracement level a profitable Exit Sell level.

Looking at the Monthly chart below, we can see how the October intramonth Low was just below the 50% retracement of the 2014 intrayear range.

Upside price objectives include 0.8498, 0.8745, 0.8879, and 0.9035.

Trade Market Options

www.trademarketoptions.com

http://goo.gl/cEJnBZ

Today's FOREX Trade of the Day was a long AUD/CHF position.

Entry Buy: 0.8379

Exit Sell: 0.8405

Notional Intraday Profit: +26 pips

Today's intraday Low of 0.8379 was right around the 38.2% retracement of yesterday's Daily range, rendering the retracement level a profitable Entry Buy level.

Today's intraday High of 1.6060 was above the 76.4% retracement level of the October intramonth range, rendering the retracement level a profitable Exit Sell level.

Looking at the Monthly chart below, we can see how the October intramonth Low was just below the 50% retracement of the 2014 intrayear range.

Upside price objectives include 0.8498, 0.8745, 0.8879, and 0.9035.

Trade Market Options

www.trademarketoptions.com

http://goo.gl/cEJnBZ

Tuesday, October 28, 2014

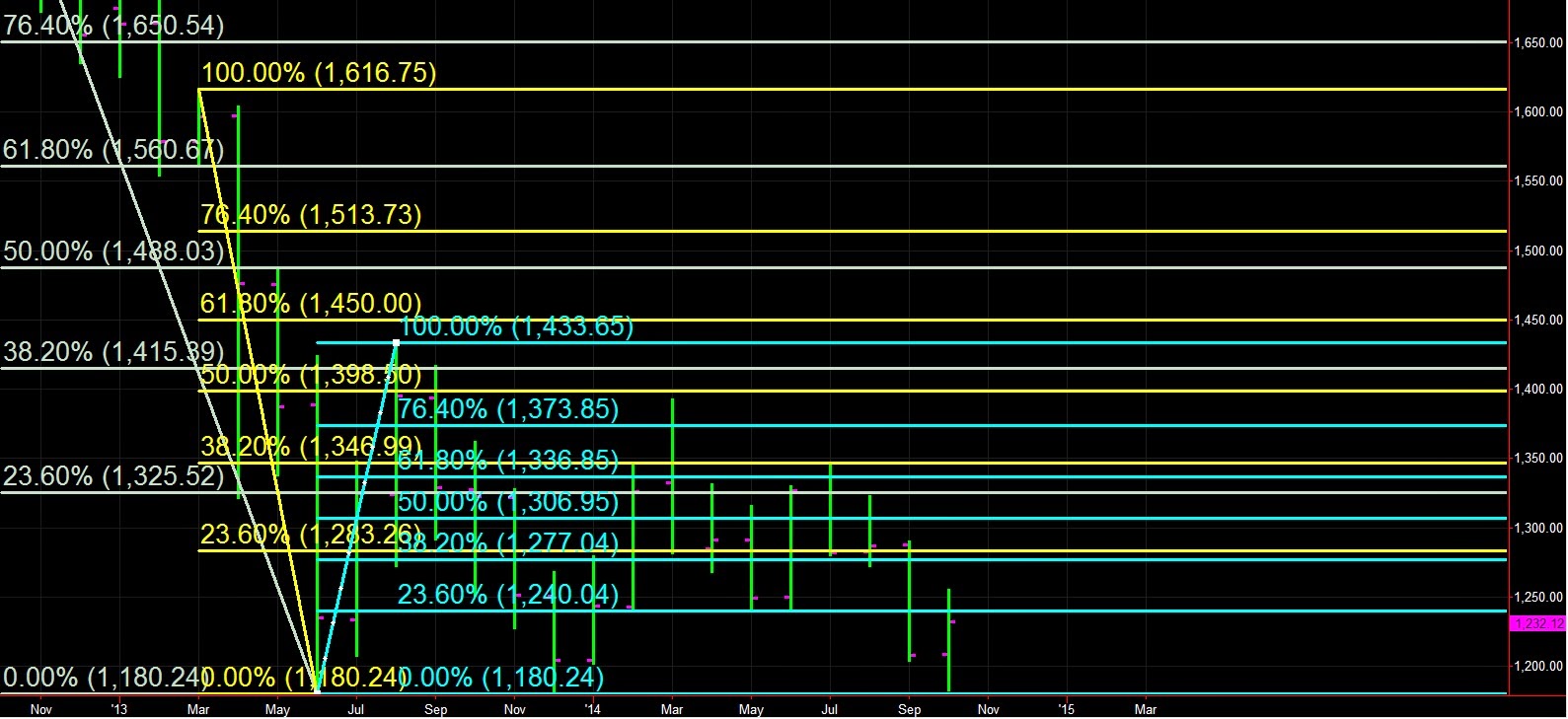

GOLD: Orbiting 1231.92 and Consolidating October's Gains

Our YouTube video illustrates Gold's recent moves against the US dollar and Gold's inability to sustain a move above the 1231.92 level.

As we can see in the Weekly chart below, Gold has had recent Weekly Closes above the 1221.17 and 1231.92 levels but was unable to close above the 1231.92 level last week.

As we can see in the Daily chart below, recent Highs and Lows have been around key levels related to the extension retracement range following the price activity of 15 October. We continue to view 1284 as an upside price objective related to this notional retracement extension range.

A close above 1240.04 on the Monthly chart below would be constructive and increase the possibility of a triple bottom formation.

Upside price objectives include 1244.85, 1262.52, and 1287.25.

Trade Market Options

www.trademarketoptions.com

http://goo.gl/cEJnBZ

As we can see in the Weekly chart below, Gold has had recent Weekly Closes above the 1221.17 and 1231.92 levels but was unable to close above the 1231.92 level last week.

As we can see in the Daily chart below, recent Highs and Lows have been around key levels related to the extension retracement range following the price activity of 15 October. We continue to view 1284 as an upside price objective related to this notional retracement extension range.

A close above 1240.04 on the Monthly chart below would be constructive and increase the possibility of a triple bottom formation.

Upside price objectives include 1244.85, 1262.52, and 1287.25.

Trade Market Options

www.trademarketoptions.com

http://goo.gl/cEJnBZ

FOREX Trade of the Day: Sell EUR/NZD

Our YouTube video illustrates today's FOREX Trade of the Day and identifies further downside price objectives.

Today's FOREX Trade of the Day was a short EUR/NZD position.

Entry Sell: 1.6098

Exit Buy: 1.6061

Notional Intraday Profit: +37 pips

Today's intraday High of 1.6106 was above the the 38.2% retracement of the range from the 22 October Low through the 24 October High, rendering the retracement level a profitable Entry Sell level.

Today's intraday Low of 1.6060 was just below the 50.0% retracement level of the same range, rendering the retracement level a profitable Exit Buy level.

Looking at the Weekly EUR/NZD chart below, we can see how the cross is just above a key retracement level of 1.6050 and how the market tested 1.5927 last week.

Downside price objectives include 1.5927, 1.5848, and 1.5654.

Trade Market Options

www.trademarketoptions.com

http://goo.gl/cEJnBZ

Today's FOREX Trade of the Day was a short EUR/NZD position.

Entry Sell: 1.6098

Exit Buy: 1.6061

Notional Intraday Profit: +37 pips

Today's intraday High of 1.6106 was above the the 38.2% retracement of the range from the 22 October Low through the 24 October High, rendering the retracement level a profitable Entry Sell level.

Today's intraday Low of 1.6060 was just below the 50.0% retracement level of the same range, rendering the retracement level a profitable Exit Buy level.

Looking at the Weekly EUR/NZD chart below, we can see how the cross is just above a key retracement level of 1.6050 and how the market tested 1.5927 last week.

Downside price objectives include 1.5927, 1.5848, and 1.5654.

Trade Market Options

www.trademarketoptions.com

http://goo.gl/cEJnBZ

Monday, October 27, 2014

APPLE: 1 week into ApplePay, AAPL Has $108 Handle in Sight

Our YouTube video illustrates Apple's move to an all-time High and identify some key upside price objectives.

Looking at the Daily chart below, the markets are looking to see if AAPL can establish a base above the previous High of 103.74. We can also see the $108 handle as an upside price objective related to an extension retracement.

The 95.90 level has been supportive in September and October as we can see on this Weekly chart below.

January 2014's move lower to 70.51 became a key extension retracement anchor and opened up the 119.54 level as a very aggressive upside price objective. We can see the October intramonth Low of 95.18 is just above the 38.2% retracement of that notional extension range in the Monthly chart below.

Trade Market Options

www.trademarketoptions.com

http://goo.gl/cEJnBZ

Looking at the Daily chart below, the markets are looking to see if AAPL can establish a base above the previous High of 103.74. We can also see the $108 handle as an upside price objective related to an extension retracement.

The 95.90 level has been supportive in September and October as we can see on this Weekly chart below.

January 2014's move lower to 70.51 became a key extension retracement anchor and opened up the 119.54 level as a very aggressive upside price objective. We can see the October intramonth Low of 95.18 is just above the 38.2% retracement of that notional extension range in the Monthly chart below.

Trade Market Options

www.trademarketoptions.com

http://goo.gl/cEJnBZ

FOREX: Australian Dollar the Top Trendsetter with Upside Burst

Our YouTube video illustrates the Australian Dollar's recent string of 6 consecutive Daily gains on our proprietary Australian Dollar Activity Index. This represented Aussie's best run since late August.

A$'s gains didn't really come at the expense of the US dollar as we can see in the AUD/USD chart below. The 0.8821 level has been good resistance.

We've seen some good selling pressure at 1.4509 in EUR/AUD as the Daily chart below shows.

The AUD/CAD Daily chart below shows some good demand around 0.9821 and 0.9789.

AUD/JPY has been a one-way street as we can see in the Daily chart below.

AUD/NZD has found good buying action at 1.1061 and 1.1006 as we can see on the Daily chart below.

GBP/AUD has had major problems at 1.8395 as we can see in the Daily chart below.

Finally, AUD/CHF demand has been decent at 0.8349 and 0.8230.

Trade Market Options

www.trademarketoptions.com

http://goo.gl/cEJnBZ

A$'s gains didn't really come at the expense of the US dollar as we can see in the AUD/USD chart below. The 0.8821 level has been good resistance.

We've seen some good selling pressure at 1.4509 in EUR/AUD as the Daily chart below shows.

The AUD/CAD Daily chart below shows some good demand around 0.9821 and 0.9789.

AUD/JPY has been a one-way street as we can see in the Daily chart below.

AUD/NZD has found good buying action at 1.1061 and 1.1006 as we can see on the Daily chart below.

GBP/AUD has had major problems at 1.8395 as we can see in the Daily chart below.

Finally, AUD/CHF demand has been decent at 0.8349 and 0.8230.

Trade Market Options

www.trademarketoptions.com

http://goo.gl/cEJnBZ

FOREX Trade of the Day: Buy EUR/USD

Our YouTube video illustrates today's FOREX Trade of the Day and identifies further upside price objectives.

Today's FOREX Trade of the Day was a long EUR/USD position.

Entry Buy: 1.2671

Exit Sell: 1.2699

Notional Intraday Profit: +28 pips

Today's intraday Low of 1.2671 was right around the the 38.2% retracement of Friday's Daily range, rendering the retracement level a profitable Entry Buy level.

Today's intraday High of 1.2713 was below the 38.2% retracement level of the range from the 21 October High through the 23 October Low, rendering the retracement level a profitable Exit Sell level.

Looking at the EUR/USD Monthly chart below, we can see how technical this trade has been with the intramonth High above a key retracement area dating to July 2008 and the October intramonth Low right around the 23.6% retracement of the range from July 2012 Low through the 2014 High.

Upside price objectives include 1.2782, 1.2853, 1.3054, 1.3247.

Trade Market Options

www.trademarketoptions.com

http://goo.gl/cEJnBZ

Today's FOREX Trade of the Day was a long EUR/USD position.

Entry Buy: 1.2671

Exit Sell: 1.2699

Notional Intraday Profit: +28 pips

Today's intraday Low of 1.2671 was right around the the 38.2% retracement of Friday's Daily range, rendering the retracement level a profitable Entry Buy level.

Today's intraday High of 1.2713 was below the 38.2% retracement level of the range from the 21 October High through the 23 October Low, rendering the retracement level a profitable Exit Sell level.

Looking at the EUR/USD Monthly chart below, we can see how technical this trade has been with the intramonth High above a key retracement area dating to July 2008 and the October intramonth Low right around the 23.6% retracement of the range from July 2012 Low through the 2014 High.

Upside price objectives include 1.2782, 1.2853, 1.3054, 1.3247.

Trade Market Options

www.trademarketoptions.com

http://goo.gl/cEJnBZ

Wednesday, October 22, 2014

GOLD Challenges 50-Day Moving Average On Ascent to 1284

Our YouTube video illustrates Gold's continued price appreciation and identifies key upside price objectives. In recent YouTube videos and posts, we have detailed Gold's technical momentum higher.

Looking at the Daily chart below, we can see our 1284 upside price objective, relating to an extension retracement area based on the 15 October Daily Low. We can see how recent Lows have been around key extension retracement areas, indicating upside price momentum. We also see how Gold is currently challenging the 50-day Moving Average.

Looking at the Weekly chart below, we can see that this week's Low and last week's Low have been above key technical retracement areas, related to the range from early July through early October and the absolute 2014 intrayear range. We also see Gold trading above the 1244.85 level, the 38.2% retracement of the range from July through October.

Downside price objectives include 1253.07, 1260.30, and 1284.20.

Trade Market Options

www.trademarketoptions.com

http://goo.gl/cEJnBZ

Looking at the Daily chart below, we can see our 1284 upside price objective, relating to an extension retracement area based on the 15 October Daily Low. We can see how recent Lows have been around key extension retracement areas, indicating upside price momentum. We also see how Gold is currently challenging the 50-day Moving Average.

Downside price objectives include 1253.07, 1260.30, and 1284.20.

Trade Market Options

www.trademarketoptions.com

http://goo.gl/cEJnBZ

FOREX Trade of the Day: Sell GBP/NZD

Our YouTube video illustrates today's FOREX Trade of the Day and identifies further downside price objectives.

Today's FOREX Trade of the Day was a short GBP/NZD position.

Entry Sell: 2.0262

Exit Buy: 2.0189

Notional Intraday Profit: +73 pips

Today's intraday High of of 2.0265 was just above the the 38.2% retracement of the range from yesterday's High through yesterday's Close, rendering the retracement level a profitable Entry Sell level.

Today's intraday Low of 2.0169 was below the 50.0% retracement level of the range from the 15 October Low through the 16 October High, rendering the retracement level a profitable Exit Buy level.

Looking at this cross rate's Monthly chart below, we can see how technically this cross has traded in 2013 and 2014, as identified by up and down arrows. GBP/NZD may be a cross rate that most FX traders don't follow, but this is another validation that there is often more alpha on the cross rates than the majors.

Downside price objectives include 2.0115, 2.0068, and 1.9836.

Trade Market Options

www.trademarketoptions.com

http://goo.gl/cEJnBZ

Today's FOREX Trade of the Day was a short GBP/NZD position.

Entry Sell: 2.0262

Exit Buy: 2.0189

Notional Intraday Profit: +73 pips

Today's intraday High of of 2.0265 was just above the the 38.2% retracement of the range from yesterday's High through yesterday's Close, rendering the retracement level a profitable Entry Sell level.

Today's intraday Low of 2.0169 was below the 50.0% retracement level of the range from the 15 October Low through the 16 October High, rendering the retracement level a profitable Exit Buy level.

Looking at this cross rate's Monthly chart below, we can see how technically this cross has traded in 2013 and 2014, as identified by up and down arrows. GBP/NZD may be a cross rate that most FX traders don't follow, but this is another validation that there is often more alpha on the cross rates than the majors.

Downside price objectives include 2.0115, 2.0068, and 1.9836.

Trade Market Options

www.trademarketoptions.com

http://goo.gl/cEJnBZ

Tuesday, October 21, 2014

FOREX Trade of the Day: Sell USD/JPY

Our YouTube video illustrates today's FOREX Trade of the Day and identifies further downside price objectives.

Today's FOREX Trade of the Day was a short USD/JPY position.

Entry Sell: 107.00

Exit Buy: 106.28

Notional Intraday Profit: +72 pips

Today's intraday High of of 107.00 was right around the 38.82% retracement of yesterday's Daily range, rendering the retracement level a profitable Entry Sell level.

Today's intraday Low of 106.24 was below the 50.0% retracement level of the range from the 15 October Low through yesterday's High, rendering the retracement level a profitable Exit Buy level.

Look at the Monthly chart below and see how the October intramonth Low was just below the 50% retracement of the range from the High in early 2002 through the Low in late 2011.

Downside price objectives include 105.60, 103.85, and 103.10.

Trade Market Options

www.trademarketoptions.com

http://goo.gl/cEJnBZ

Today's FOREX Trade of the Day was a short USD/JPY position.

Entry Sell: 107.00

Exit Buy: 106.28

Notional Intraday Profit: +72 pips

Today's intraday High of of 107.00 was right around the 38.82% retracement of yesterday's Daily range, rendering the retracement level a profitable Entry Sell level.

Today's intraday Low of 106.24 was below the 50.0% retracement level of the range from the 15 October Low through yesterday's High, rendering the retracement level a profitable Exit Buy level.

Look at the Monthly chart below and see how the October intramonth Low was just below the 50% retracement of the range from the High in early 2002 through the Low in late 2011.

Downside price objectives include 105.60, 103.85, and 103.10.

Trade Market Options

www.trademarketoptions.com

http://goo.gl/cEJnBZ

Monday, October 20, 2014

OIL: After Technical Thursday, Oil Bears Refocus on Our Downside Targets

Our YouTube video

illustrates the recent price activity in Brent crude Oil and WTI Oil and examines the technical significance of Thursday's short-lived pullbacks higher.

In the Brent crude Oil Daily chart below, we see that Thursday's retracement higher was to the 23.6% retracement of the High from 26 August through the October intramonth Low.

Similarly, in the WTI Oil Daily chart below, we see that Thursday's retracement higher was to the 23.6% retracement of our downside price objective.

Trading activity since the Thursday moves higher has been technical, including today's trading activty.

First in Brent crude...

Second in WTI...

Our downside price objective for Brent crude remain unchanged as we can see on the following Monthly chart. We still anticipate a move lower to the $81 handle.

Likewise, our downside price objective for WTI Oil remains unchanged with a pullback to the $76-77 handle area possible.

Trade Market Options

www.trademarketoptions.com

http://goo.gl/cEJnBZ

In the Brent crude Oil Daily chart below, we see that Thursday's retracement higher was to the 23.6% retracement of the High from 26 August through the October intramonth Low.

Similarly, in the WTI Oil Daily chart below, we see that Thursday's retracement higher was to the 23.6% retracement of our downside price objective.

Trading activity since the Thursday moves higher has been technical, including today's trading activty.

First in Brent crude...

Second in WTI...

Our downside price objective for Brent crude remain unchanged as we can see on the following Monthly chart. We still anticipate a move lower to the $81 handle.

Likewise, our downside price objective for WTI Oil remains unchanged with a pullback to the $76-77 handle area possible.

Trade Market Options

www.trademarketoptions.com

http://goo.gl/cEJnBZ

DOW (DJIA): Fed Talked Dow Higher Last Week to 16,426

Our YouTube video illustrates Friday's trading activity in the Dow Jones Industrial Average (DJIA) following verbal intervention from the Federal Reserve including market-supportive comments last week from St. Louis Federal Reserve President Bullard.

As we can see in the Daily chart below, the Dow's Daily High was right around the 38.2% retracement of the range from the all-time High reached in September through the October intramonth Low.

We also see the 15615 level, the area that would represent a technical correction.

Looking at the Monthly chart below, we can see that the market hasn't yet tested the 15711 level in October but that it is an important technical level.

The markets should not be surprised that we perfectly tested the 16426 area on Friday. Looking at the Weekly chart below, we see how the 16096 level is significant technically.

That's why the market elected more than $150 in Stops below this level in the first 10 minutes of trading last Wednesday as we can see in this 5-minute chart below.

Downside price objectives remain 15711, 15524, and 15320.

Trade Market Options

www.trademarketoptions.com

http://goo.gl/cEJnBZ

As we can see in the Daily chart below, the Dow's Daily High was right around the 38.2% retracement of the range from the all-time High reached in September through the October intramonth Low.

We also see the 15615 level, the area that would represent a technical correction.

Looking at the Monthly chart below, we can see that the market hasn't yet tested the 15711 level in October but that it is an important technical level.

The markets should not be surprised that we perfectly tested the 16426 area on Friday. Looking at the Weekly chart below, we see how the 16096 level is significant technically.

That's why the market elected more than $150 in Stops below this level in the first 10 minutes of trading last Wednesday as we can see in this 5-minute chart below.

Downside price objectives remain 15711, 15524, and 15320.

Trade Market Options

www.trademarketoptions.com

http://goo.gl/cEJnBZ

Subscribe to:

Posts (Atom)